Remote working technologies have driven unprecedented business growth in recent years, empowering companies to hire top talent from anywhere in the world. That said, global payroll challenges persist even in this era of flexibility.

The technical and legal complexities of paying employees who reside in different countries present serious obstacles to global hiring. But it’s not all doom and gloom. Armed with the right solutions, experts, and knowledge, you can successfully streamline global payroll to achieve compliance, operational efficiency, and accuracy at scale.

This article is going to discuss some actionable solutions to the most common global payroll challenges that your SME might run into. But first, what is global payroll?

What is global payroll?

It is essentially regular payroll on a much larger scale. It’s the process of managing payroll for employees, contractors, and freelancers in international locations via a centralized system.

Payroll activities include things such as, calculating and paying salaries and wages, managing employee expenses, and ensuring employment law compliance.

As global payroll involves managing payroll in two or more countries, the process must take into account country-specific differences—for example, different employment laws, tax legislation, currencies, compliance regulations, cultural differences, and more.

Hiring remote workers dissolves geographical restrictions on talent, allowing you to partner with employees from around the world. It enriches diversity and inclusion, powering better problem-solving and innovation. And, when done right, it’s been proven to increase employee well-being, productivity, and job satisfaction.

But, without strategic global payroll implementation, certain challenges can thwart this multitude of benefits.

Five payroll challenges and their solutions

To maximize the value of global hiring, you need to be able to navigate any payroll challenges that threaten to hinder prosperity and growth. These include:

1. Local payroll regulation, employment, and tax compliance

The laws and regulations that govern payroll, employment, reporting requirements, and taxes will differ from country to country. If you hire international employees, you need to learn and apply local regulations and laws to your payroll.

This includes staying up-to-date with each country’s minimum wage increases, tax changes, social security contributions, and other local regulations.

In the UK, for example, the governing tax body is HMRC, while in the US, it’s the IRS. Both bodies have different rules for income tax payments, tax filing, and deductible expenses.

Failing to abide by these laws puts you at risk of financial penalties, lawsuits, and even criminal charges.

The solution: Constant monitoring of local regulations and updating payroll policies

A global system can consolidate payroll data. This makes it easier to manage nuanced local requirements (payroll rules, deadlines, deductions, etc) for your globally-dispersed employees. This centralization of data is combined with automated document-checking to guarantee compliance with international laws and regulations.

Alongside this system, you can hire or outsource global payroll professionals. 73% of companies outsource some aspect of payroll despite the higher costs of doing so (in part because they struggle to manage global legislation internally).

Global payroll experts will monitor international legislation changes and perform necessary updates to your payroll system.

2. Managing multiple currency payments

Currency exchange rates are forever in flux, and trying to manage multiple currencies manually increases the risk of human error, making it more likely your international employees will receive incorrect or unreliable payments.

That’s not all. Incorrect currency calculations can cause your payroll expenditures to soar. Given that it’s likely your employees are already your business’s largest expense, this can easily skyrocket your outgoings.

The solution: Use a payment platform or system that can handle multiple currencies

To be sure that employees are paid the right amount, use an automated payment platform that can handle multiple currencies. This should be able to deliver automated payments in local currencies, eliminating the need to manage several international currency accounts.

Using in-house payment platforms instead of outsourcing can help you achieve more cost-effective global mobility.

3. Privacy and security risks

Global payroll complexities and uncertainties can pose significant data security risks. When you collect sensitive data from employees around the world, it’s critical to understand, keep up-to-date with, and abide by country-specific data privacy laws.

71% of countries have data privacy legislation, according to UNCTAD. For example, the General Data Protection Regulation (GDPR) protects sensitive data in Europe. In the US, it’s the California Consumer Privacy Act (CCPA). In South Africa, the Protection of Personal Information Act (POPIA) is the governing legislation.

Violating these laws can have serious financial, reputational, and even legal repercussions. GDPR violations, for example, can incur fines of up to €20 million (or four percent of your company’s annual revenue—whichever is higher).

The solution: Implement strong access controls and regular system audits

One way to address this is by implementing stringent access controls, permissions, and authentication rules throughout your systems. Conduct regular audits and vulnerability testing to identify, resolve, and mitigate threats.

Critically educate your payroll team on cybersecurity best practices to help guarantee compliance.

4. Payroll accuracy and timeliness

Paying employees accurately and on time is one of the biggest challenges of global payroll management. The confusion and complexities surrounding international laws, currencies, and compliance—not to mention data overwhelm—can easily lead to payroll inaccuracies and poor employee experiences.

The solution: Use a payroll calendar or automated payroll systems

The solution? Use a payroll calendar or, even better, an automated payroll system to provide accuracy and timeliness.

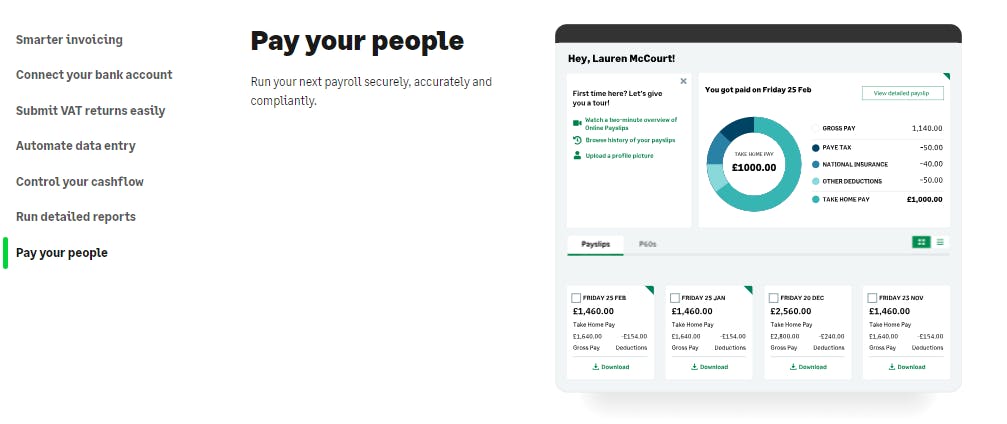

For smaller businesses, the best accounting software will automate payroll calculations in alignment with local tax regulations (such as, the UK’s HMRC, for example). As a result, you can deliver encrypted payslips to your employees on time, every time.

5. Data management and reporting

Your team also needs to regularly collect employee data to keep track of promotions, bonuses, illnesses, and terminations. That said, the more employees you have spanning multiple countries, the more data you’ll need to amass, organize, and interpret.

This can quickly overwhelm your teams, especially if they’re having to pull (and potentially translate) data from multiple siloed sources. The result is data discrepancies that slow down processes and increase off-cycle payments.

In these conditions, reporting also becomes a nightmare—especially if it’s being done manually. Teams are unable to compile the data they need in real-time, which can lead to out-of-date, inaccurate reporting.

The solution: Centralize data and use automated reporting tools

Centralizing and automating data management is critical to address this issue. A recent study by EY showed that businesses using six or more payroll providers were over twice as likely to experience problematic issues relating to data management and global reporting.

Fortunately, enterprise resource management, or ERP software, can centralize data across disparate systems and automate labor-intensive administration. By consolidating data and streamlining operational obstacles, payroll can access employee data from finance and HR in real-time and collaborate across countries, languages, and legislation.

Data centralization also facilitates accurate automated reporting. Reporting tools can be used to continuously gather data for real-time analysis, powering actionable insights and strategic decision-making.

Three features to look for in a global payroll service system

A global payroll service system empowers you to recruit the best international talent. But with so many solutions out there, how do you choose the right one for your business?

We’ve narrowed it down to three main features that you should prioritize to set you up for success.

Easy implementation

Like any large-scale initiative, global payroll system implementation has the potential to be tedious and lengthy. At worst, it can completely derail your payroll process. Luckily, with an efficient, trustworthy provider, you can painlessly accelerate your time to implementation.

It pays to shop around before diving in. Look for a provider who’s transparent about their implementation and onboarding process—most will be able to give you a step-by-step timeline. You can also read case studies to gauge expected timescales.

Scalability

Once you’ve successfully standardized and managed global payroll processes in one country, there should be nothing stopping you from targeting another country (and another).

Make sure your global payroll solution facilitates your business’s growth potential thanks to its inherent scalability. Agile solutions will not only allow you to scale up and down in alignment with your needs but offer integrations to maximize efficiency and innovation.

Data security and compliance

Prioritizing data security and compliance is the best way to avoid severe financial and legal fallout.

The global payroll solution you choose should be able to demonstrate data security and compliance via certifications and expertise.

Analyze the provider’s business website, service system features, and relevant case studies to make sure you’re using a secure, professional, and compliant solution.

Overcome global payroll challenges

For the most part, global payroll challenges are to be expected. If you’re new to international hiring, navigating local labor laws, currencies, tax, and compliance regulations will be a steep learning curve—but you don’t have to do it alone.

With the right global payroll solutions and automation technologies, you can prepare for, mitigate, and resolve any challenges. Centralize data to keep on top of local requirements, and automate your payroll to access error-free calculations and timely delivery regardless of location. Implement strict access controls to harden security too.

By doing so, you can provide a better employee experience for your globally-dispersed staff and enjoy the numerous business benefits brought about by remote working.